You or a loved one made the wise decision to buy a long-term care insurance (LTCI) policy, great choice! Now what? When are you eligible to receive the benefits?

Benefit Triggers

LTCI policies have “benefit triggers” that will enable you to qualify for benefits.

Most LTC policies have 2 ways to trigger your benefits.

#1- a physical impairment OR #2 – a cognitive impairment.

Physical Impairment

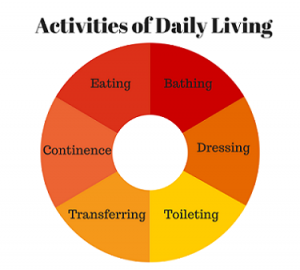

A physical impairment means you need substantial assistance with at least 2 out of the 6 Activities of Daily Living (ADLs).

Activities of Daily Living

- Transferring

- Toileting

- Bathing

- Dressing

- Eating

- Continence

Walking is not an ADL used by LTC insurance to measure benefit eligibility.

Insurance companies refer to ADL help as “hands-on assistance” or “standby assistance.”

Hands-on assistance means you receive direct, physical assistance from another person without which you would be unable to perform an ADL. A hands-on assistance only requirement is more restrictive than stand-by assistance.

Standby assistance means you need another person to physically be within arm’s reach to prevent, by physical intervention, injury while you’re performing an ADL.

Most policies sold today define “substantial assistance” as needing hands-on assistance OR stand-by assistance, not both.

Cognitive Impairment

A cognitive impairment means there’s been a deterioration or loss in mental capacity which requires substantial supervision to protect yourself or others from threats to health and safety. Severe cognitive impairment is measured by clinical evidence and standardized tests that measure impairment in the following areas:

- Short-term or long-term memory

- Orientation to people, places and time or

- Deductive or abstract reasoning or

- Judgment as it relates to safety awareness

“Substantial” supervision means you need someone, not necessarily a professional, to provide continual supervision. This may include cuing by verbal prompting, gestures or other demonstrations and must be necessary to protect you from threats to your health and safety, such as may result from wandering.

An example of a severe cognitive impairment would be if you need substantial supervision due to Alzheimer’s disease or dementia.

You only need to have a physical OR cognitive impairment, not both.

Tax-qualified policies issued since 1997 require that your need of assistance with ADLs be certified by a doctor, nurse, or licensed social worker and that your need of care is expected to last at least 90 days. At least 90 days signifies “long-term” as opposed to “short-term.” Policies before 1997 generally do not include the word “substantial” for a cognitive impairment claim. These policies do not require the supervision be continual (24/7) even though they are grandfathered as tax-qualified.

After your doctor affirms your need of care is expected to last more than 90 days, a “Plan of Care” must be established. A Plan of Care is a written individualized plan prescribed and signed by a licensed health care practitioner. It specifies your long-term care needs and the type, frequency, and providers of the services appropriate to meet the needs and the costs of those services. After you’ve fulfilled your elimination period or waiting period, you will receive your benefits either through reimbursement or cash indemnity, whatever is specified in your policy.

The Bottom Line

To be eligible for your benefits, you must meet the benefit triggers of the policy, either a physical or cognitive impairment. Your expected need of care must be at least 90 days, you must have a Plan of Care, and you must fulfill your elimination period. Then you receive benefits! Check your policy for details.