Hybrid/asset based/linked benefit long-term care insurance

These three names are often used interchangeably for the same type of long-term care insurance and can confuse people! So what does it mean?

With this type of insurance, you are linking one benefit (long-term care insurance) with another benefit (life insurance or an annuity). I’ll refer to this type of insurance as hybrid long-term care (LTC) insurance. While traditional LTC insurance is simply pure risk based insurance like your home or auto insurance, hybrid LTC insurance has either a death benefit from life insurance OR cash value from an annuity.

Hybrid Long-Term Care Insurance Premiums

Hybrid policy premiums are guaranteed to stay the same and won’t increase, which some people like because it allows them to budget in the future for what their exact premiums will be. Premiums can be paid in a variety of ways, such as paying on a reoccurring basis by making annual payments, a limited pay such as 5-pay, 10-pay, 20-pay, or a single deposit or a combination of a single deposit and reoccurring payments.

Tax Advantages

Some hybrid policies separate their LTC and life insurance premiums, which gives you the opportunity to deduct just the long- term care insurance premiums (not the life insurance premium), depending upon your age or structure of business. There is preferential tax treatment for people that want to repurpose existing permanent life insurance or an annuity via a 1035 exchange. This allows them to leverage their money, not pay tax on the gains, and get tax free long-term care benefits.

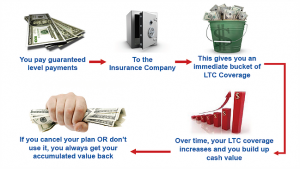

If you want to make a single deposit in a hybrid plan with the insurance company, it would look something like this: you take a dollar, deposit it with the insurance company, and you immediately have about 2-3 times as many dollars of tax free long term care coverage. Over time, both your original dollar and the long-term care coverage grows. If you cancel your plan or don’t use it, you get your accumulated value back (your $1 plus interest).

Hybrid plans are more expensive than traditional policies because of the extra benefit of either a death benefit or cash value.

Reimbursement vs. Cash

Insurance companies that offer hybrid plans have either a reimbursement or cash indemnity plan. A reimbursement plan requires you to submit monthly receipts and get reimbursed. If receiving care in a facility or using a home care agency, the insurance company can often direct bill the facility or agency.

Cash indemnity plans don’t require you to submit monthly receipts and instead you receive a monthly check to spend the way you wish.

How Long Can I Receive Benefits?

Most hybrid plans allow you to receive benefits between 2 and 7 years. Although if you don’t use your full monthly benefit, it will last longer. There is a hybrid plan that offers lifetime unlimited benefits which means once you’re on claim, you receive your monthly benefit as long as you need it, there is no time limit! That would be very valuable especially if there is a cognitive impairment like Alzheimer’s, Dementia, or Parkinson’s.

Will I Health Qualify for a Hybrid Policy?

Medical underwriting is less strict in hybrid plans as opposed to traditional policies, where it can be more difficult to get someone health approved.

The Bottom Line

Hybrid long-term care insurance policies provide coverage if you need extended care. If you don’t need care, there is value in the plan that can be passed on to your beneficiaries.