Washington State passed a new law mandating public long-term care (LTC) benefits for Washington residents. It’s the first public program in the U.S. that will be funded by employee wages (payroll deduction). The WA Long-Term Care Trust Act was created to reduce pressure on the Medicaid system. This program may be appropriate for Washington State residents with average income and/or health conditions that prohibit them from obtaining private coverage. However, it may not be in your best interest.

Under current law, you can opt-out of this tax by having a long-term care insurance (LTCi) policy in place by November 1st, 2021.

What is the Tax?

Beginning January 1st, 2022, Washington residents will fund the program via a payroll tax. This tax is permanent and applies to all residents, even if your employer is located outside of the state.

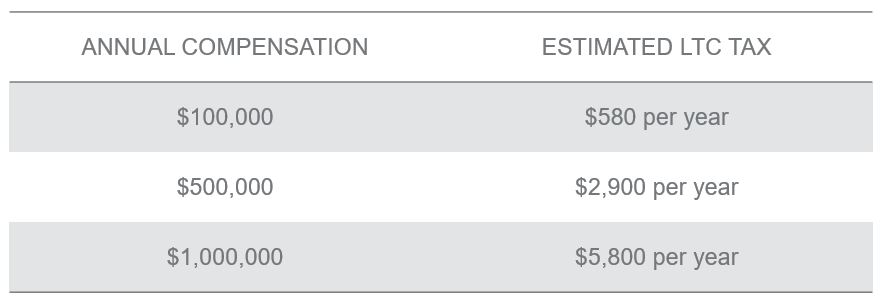

The tax is currently set at 0.58% or $0.58 per $100 of payroll. This means for every $1,000 you make in 2022 and beyond, you will have $5.80 deducted to pay for this new benefit. Can the tax go up in the future? Yes. The program has to be financially sustainable and if it’s not, they’ll increase the tax.

Is There a Cap On the Amount of Taxed Wages?

There is NO cap on wages, unlike other state insurance programs. All wages and remuneration, including stock-based compensation, bonuses, paid time off, and severance pay, are all subject to the tax.

What’s the Benefit?

Once vested, you will be eligible to access $100 a day, up to a maximum lifetime benefit of $36,500 (adjusted for inflation) to pay for expenses associated with needing assistance with activities of daily living (ADLs). Private insurance only requires you to be unable to do 2 ADLs, while the State Plan requires that individuals need assistance with 3 ADLs. Examples of ADLs are dressing, bathing, eating, toileting, transferring, cognitive impairment, and other basic functions.

This is a direct reimbursement plan where the care provider is reimbursed directly. The care provider you use MUST be a state approved provider.

Vesting Requirements

To receive benefits, you must work for:

- At least 10 years at any point in your life without a break of 5 or more consecutive years, OR

- 3 of the last 6 years at the time you apply for the benefit, AND

- At least 500 hours per year during those years

Note: Employees retiring before participating for 10 years in the program will only have temporary vesting.

Who is Eligible to Receive Benefits?

- Washington State employees who are vested

- 18 years or older

- Meet the requirement for assistance for ADLs

- Have not exhausted lifetime benefits ($36,500)

Those who do not meet the vesting requirements and those already currently retired will not be eligible for the long-term care program benefits.

Benefits are not payable until January 1, 2025 and are not portable or payable if you reside outside of Washington state when you need benefits.

Are Self-Employed Individuals Exempt?

Yes, self-employed individuals are exempt from the program if they don’t have W-2 income, but may choose to opt-in. Under the program, self-employed individuals must opt-in by January 1, 2025, or within 3 years of becoming self-employed for the first time. If a self-employed person does not apply for the exemption now and later returns to work as a W-2 employee, they will be subject to the LTC tax.

Who Might Want to Opt-In?

- If you make less than $50k/yr

- If you plan to stay in WA continuously throughout retirement

- If you’re in poor health (WA plan is guaranteed issue)

Who Might Want to Opt-Out?

- Higher income earners ($100k/yr +) now or in the future who could buy a more meaningful LTCi policy for less premium than the payroll tax

- Younger employees who are newer to the workforce and would pay into the fund for decades, ultimately paying more in tax than they would receive in benefit

- Employees who plan on retiring before the benefits are available (1/1/2025)

- Employees who plan on retiring in less than 10 years

- Employees who want coverage with spouse

- Employees who want to be able to customize and determine own coverage

- Employees who plan on retiring outside the state of Washington or want the flexibility to move

- Self-employed individuals who are considering returning to work for another company where they would be a W-2 employee

How Much is a Private Long-Term Care Insurance Policy?

Premiums for LTCi policies depend on a variety of factors, including: your age, gender, health, benefit period, monthly benefit, etc. Premiums are typically paid annually, but there are limited pay and single pay options. With traditional LTCi policies, there is a slight risk that premiums will increase over time, but with hybrid policies premiums are guaranteed.

If you’re younger than 40, there are limited options right now. A life insurance policy with a LTC rider may be your best option. Also, most companies won’t issue policies if you’re over age 75.

LTCi coverage costs more for women than for men because women file 2/3 of all LTCi claims. Women typically live longer than men and also provide care for their husbands, reducing claims from men. Long-term care policy discounts may be available for those who are married and apply for joint coverage with their spouse.

Obtaining LTCi coverage typically requires an application, telephone interview to review their medical history, possibly a cognitive exam, and medical records. Coverage is not available to those who have a cognitive diagnosis like Alzheimers, Parksinsons, Dementia, or certain other health issues.

What Could Long-Term Care Cost in the Future When You Need It?

According to the 2020 Genworth Cost of Care survey, the average cost in Washington per month is:

- $10,950 for nursing home care (private room)

- $5,750 for assisted living

- $6,031 for home health care (based on 44 hours/week of care)

https://www.genworth.com/aging-and-you/finances/cost-of-care.html

What Private Long-Term Care Insurance Options Are There?

There are traditional LTCi policies (typically annual payments), life insurance policies with a LTC rider, and hybrid asset-based policies (single pay, limited pay or annual pay). All of these could provide better long-term care coverage for you could exempt you from the payroll tax.

How Do You Apply to Opt-Out of WA’s LTC Payroll Tax?

Between October 1, 2021 – December 31, 2022, you need to complete and file a waiver application with the state attesting that you have other long-term care insurance. Once you opt-out, it’s permanent, you cannot opt back into the program. You must provide a copy of the waiver certification to your current and all future employers, and employers must maintain a copy of this letter.

Right now, there isn’t anything in the program that prevents you from dropping your individual coverage at some point in the future after opting out of the program, but this loophole is a major concern, so the state may decide to implement an annual re-certification process in the future.

Next Steps?

If you are considering opting out and want to put a meaningful long-term care insurance policy in place, please contact us so we can evaluate your individual situation and options available to you. To ensure policies are in-force before the 11/1 deadline, we are requesting applications be submitted before the end of July. If you are looking for the cheapest plan to opt-out and don’t want a meaningful policy, please find a different source.

The Bottom Line

Compared to the state-run program, a private LTCi policy can provide more meaningful protection, built-in inflation protection, allow you to stay in control of your care options, protection from potential future state tax rate increases, and is portable to whatever state you reside in.