Long-term care insurance is more than an income stream.

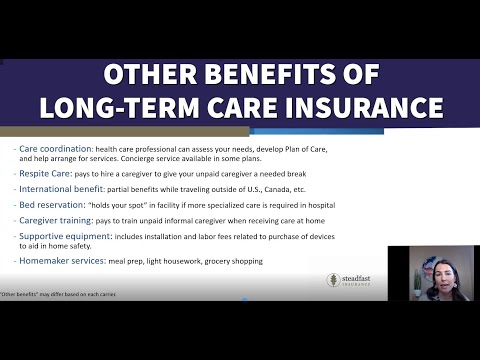

There are other benefits that generally come with an LTC policy that most people don’t know about.

What are these “other benefits”?

Care Coordination

One of the things that most policies have is care coordination and this relieves a lot of burden on your family. If you have a long-term care situation in your family, what do you do first? Who are you going to call? Do you go to Google? How do you figure out what your spouse, mom or dad needs? Do you need to look for homecare, find an agency? Do you need someone to come in and do some home modifications because you want them to stay in their home? How much care do they need?

There are so many things to consider, but with most policies, care coordination is included. They’re going to help you assess the needs of that care recipient and help to develop a Plan of Care which is going to lay out exactly what that person needs. They will also help to arrange those care services. They will recommend top-rated facilities or agencies in your area. Some carriers even have what they call concierge service, which is a single person that’s dedicated to your claim. When you call in, you have a “Susan” or one particular person for your family to talk to throughout the whole claim. This eliminates the need of having to retell your story over and over again.

Want an LTC insurance quote? Click here.

Respite Care

We know there’s a huge caregiver burnout. It’s very exhausting physically, mentally, and emotionally caregiving and those caregivers need breaks. If you have an informal caregiver, you’re able to hire short-term help (respite care) to give your caregiver a break from their responsibilities. Respite care can be arranged for part of a day, several days, or even weeks.

International Benefits

If you have a home overseas and want to receive services there, some carriers offer partial benefits.

Bed Reservation

If you are temporarily absent from your facility (e.g., assisted living, hospice, nursing facility) for any reason (e.g., hospital stay or visiting family home) other than being discharged, your policy may reserve your spot in your facility for a specified period of time.

Caregiver Training

If you have an informal (non-professional, unpaid) caregiver at home (e.g., your spouse, adult child), you can hire someone to train that person on how to properly move you, how to get from a chair to the sofa, how to go to the restroom safely, how to get on and off things, etc.

Supportive Equipment

If your loved one wants to stay home, home modifications may be necessary to keep them safe. These would include things like:

- Grab bars to assist in toileting, bathing or showering

- Pumps and other devices for IV injections

- Wheelchair ramps and stair lifts to allow movement from one level to another

Homemaker services

Many policies offer coverage for household tasks that are necessary for you to live safely and independently in your home. These services are things like meal prep, laundry, light housework, and grocery shopping; things we do on a daily/weekly basis. These household tasks can be very difficult and time consuming for someone with a chronic illness.

The Bottom Line

Long-term care insurance is more than money. There are other benefits included in most policies that provide tremendous value to the family and care recipient. These other benefits typically have specified limits in the policy. Ask your agent and read your policy for details.