Long-term care and short-term care insurance. What are the similarities and differences?

Both long-term care (LTC) and short-term care (STC) insurance provide coverage when you need care from an accident, illness, or disability.

What are the Benefit Triggers? How Do You Qualify for Benefits?

Both LTC and STC require you to have either a physical impairment where you need help with 2 out of the 6 Activities of Daily Living (ADL -transferring, toileting, bathing, dressing, eating, and continence) OR a cognitive impairment such as Alzheimer’s.

Expected Need of Care

An LTC policy requires your expected need of care to last at least 90 days, while a short-term care policy does not have an expected need of care requirement.

Substantial Assistance

Substantial assistance refers to a person needing hands-on or standby assistance. Hands-on assistance is when you need physical assistance without which you would NOT be able to perform the ADL. Standby assistance means another person needs to be present and within arm’s reach of you to provide physical intervention to prevent an injury while you’re performing an ADL. Most LTC policies state you only need to have hands-on OR standby assistance, not both. Most STC policies don’t give you the option of standby assistance, but require hands-on assistance, which is more restrictive.

Benefit Period

No surprise here – LTC policies are designed to last longer than STC policies. LTC policy benefit periods can be as little as 2 years or can last up to your whole lifetime, whereas STC policies are typically limited to 1 year of facility care and 1 year of home care. However, there what’s called restoration of benefits which means if you are on claim, then heal up and don’t need benefits for at least 180 days, your benefits will restore to their original amounts making them available in the future for a different period of care.

Benefit Amount

With an LTC policy, benefit amounts of $1,500-$15,000 per month are available. With a STC policy, benefit amounts for facility care are available from $10/day-$300/day and for home care are $150/week to $1,200/week.

How are Benefits Paid?

Most LTC policies use a reimbursement method when paying benefits, although there are a few that do offer cash. STC policies pay benefits in cash, so you don’t have to submit receipts and get reimbursed.

Elimination Period/Waiting Period

An Elimination Period (EP) or waiting period is the amount of time you must wait to receive benefits once you are benefit eligible and receiving care. LTC policies have waiting periods from 0-365 days. Some policies allow you to customize your EP, while others are set in stone. STC policies have customizable waiting periods of 0, 20 or 100 days.

Underwriting

LTC policies are stricter in underwriting compared to STC policies. LTC policies will require an application, phone interview, prescription drug check and depending on what type of policy you’re applying with, a medical exam and medical records will be necessary. STC policies require an application, prescription drug check, but a medical exam and records are NOT needed. LTC policies will take longer to get issued, sometimes months, due to the extra underwriting required. Most STC policies get issued in less than a couple of weeks.

Added Benefits

LTC policies typically have additional benefits that STC policies don’t. For example, services like care coordination, home modifications, international benefits, return of premium, respite care, caregiver training, and joint policies with a spouse to share benefits. Some STC policies do have bed reservation, like LTC policies.

Inflation Protection

Costs of care continue to rise and most likely when you buy your policy you won’t use it for years. To combat the rising care costs, LTC policies offer inflation protection from 1-5%. The most common is 3% compound which means each year, your monthly benefit and total bucket of money will grow by 3% compound. STC policies do not offer inflation protection, so many people choose a higher daily or weekly benefit at time of purchase to keep up with rising care costs.

Waiver of Premium

Do you have to pay premiums when on claim? Most LTC policies have a waiver of premium, but STC policies will require you to continue making premium payments when on claim.

Price

How much do they cost? It depends on many factors, but in general a LTC policy will be more expensive than a STC policy. Since LTC policies will last longer and typically have inflation protection, they’re going to be pricier.

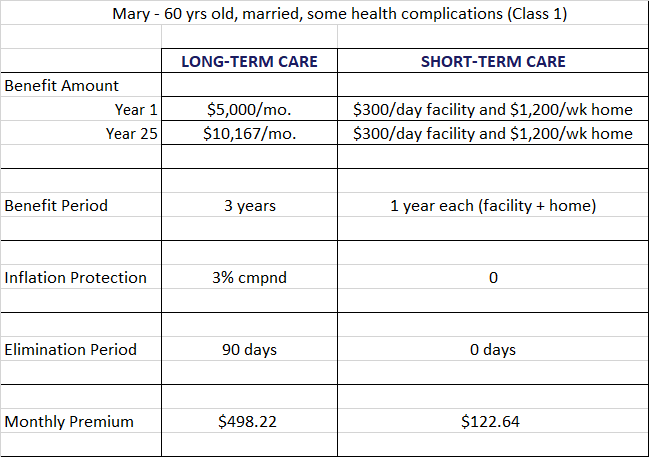

Let’s look at an example. Mary is 60 years old, married, and has some health complications (class 1).

If she applies for traditional LTC insurance with a monthly benefit of $5,000 for 3 years, 3% compound inflation protection, and 90-day elimination period, her monthly premiums would be $498.22. In 25 years, her monthly benefit will grow to $10,167. If she applies for STC insurance with a facility daily benefit of $300/day for 1 year and home care benefit of $1,200/week for 1 year, 0 day waiting period, her monthly premium would be $122.64. Since there is no inflation protection option with STC insurance, we maxed out her daily and weekly benefit to keep up with the rising costs of care. As you can see, the STC insurance is less expensive, but it’s for a shorter period and benefits don’t grow over time.

Right Fit

Who should consider LTC and STC insurance? If you’re healthy enough to qualify for a LTC policy and you can afford the premiums, get it! You’ll have more robust coverage and there typically are additional benefits that you won’t get with a STC policy. If you’re not healthy enough to qualify for or you don’t have the funds to pay for even a modest LTC policy, look into a STC policy. Some coverage is better than no coverage!

The Bottom Line

LTC and STC insurance policies provide valuable benefits and have similarities and differences. To see which one is the right fit for you, work with an independent LTC Insurance Specialist like Kelly who has different options available and is well versed in all of them.