Common Questions About Long-Term Care Insurance

Planning ahead instead of crisis planning reduces stress and the disruption of your retirement plan. Long-term care insurance is...

10 Reasons LTC Insurance is Better Than Self-Funding

Many people choose to self-fund their LTC care costs. Here are 10 reasons why LTC insurance is better than self-funding.

What is Long-Term Care?

Long-Term Care is the personal assistance you need throughout the day when your health is compromised to help maintain your quality of life.

What is Traditional Long-Term Care Insurance?

Traditional long-term care insurance is pure risk based insurance. There are no added benefits if you don't use it.

What is Hybrid Long-Term Care Insurance?

With this type of insurance, you are linking one benefit (long-term care insurance) with another benefit (life insurance or an annuity).

Who Shouldn't Buy Long-Term Care Insurance?

Not everyone should buy long-term care insurance. Wait, what, not everyone? That's right, not everyone should buy it.

How to File a Long-Term Care Insurance Claim

If you have a long-term care insurance policy, it’s important for you to talk to your loved ones about it’s details.

What to Do BEFORE Filing a Long-Term Care Insurance Claim

Your aging or ill loved one is requiring an increased level of care either at home or in a facility. You suspect they have...

Long-Term Care Insurance is More Than Money

Long-term care insurance provides valuable financial protection, but there are many other benefits that come with a policy.

5 Reasons Women Need to Plan for Long-Term Care

Planning ahead for long-term care is important, but especially for women. Women typically live longer than men, have a higher...

How to Use Health Savings Account to Pay for Long-Term Care Insurance

Did you know you can use it to pay long-term care insurance premiums? An HSA is a...

Long-Term Care Insurance Business Tax Advantages

If you’re a business owner, there are valuable tax deductions and advantages associated with long-term care insurance for you and...

Inflation Protection

Long-term care costs rise each year and inevitably will continue to, so it’s important to understand how you can leverage your insurance and use the power of inflation...

How Much Is Long-Term Care Insurance?

There are many factors that affect the price of your long-term care insurance premiums, including age, gender, health, marital status...

How to Talk to Your Family About Long-Term Care

Talking to your family about an extended care situation can be awkward and hard. Here are 5 tips on how to have that conversation and 4...

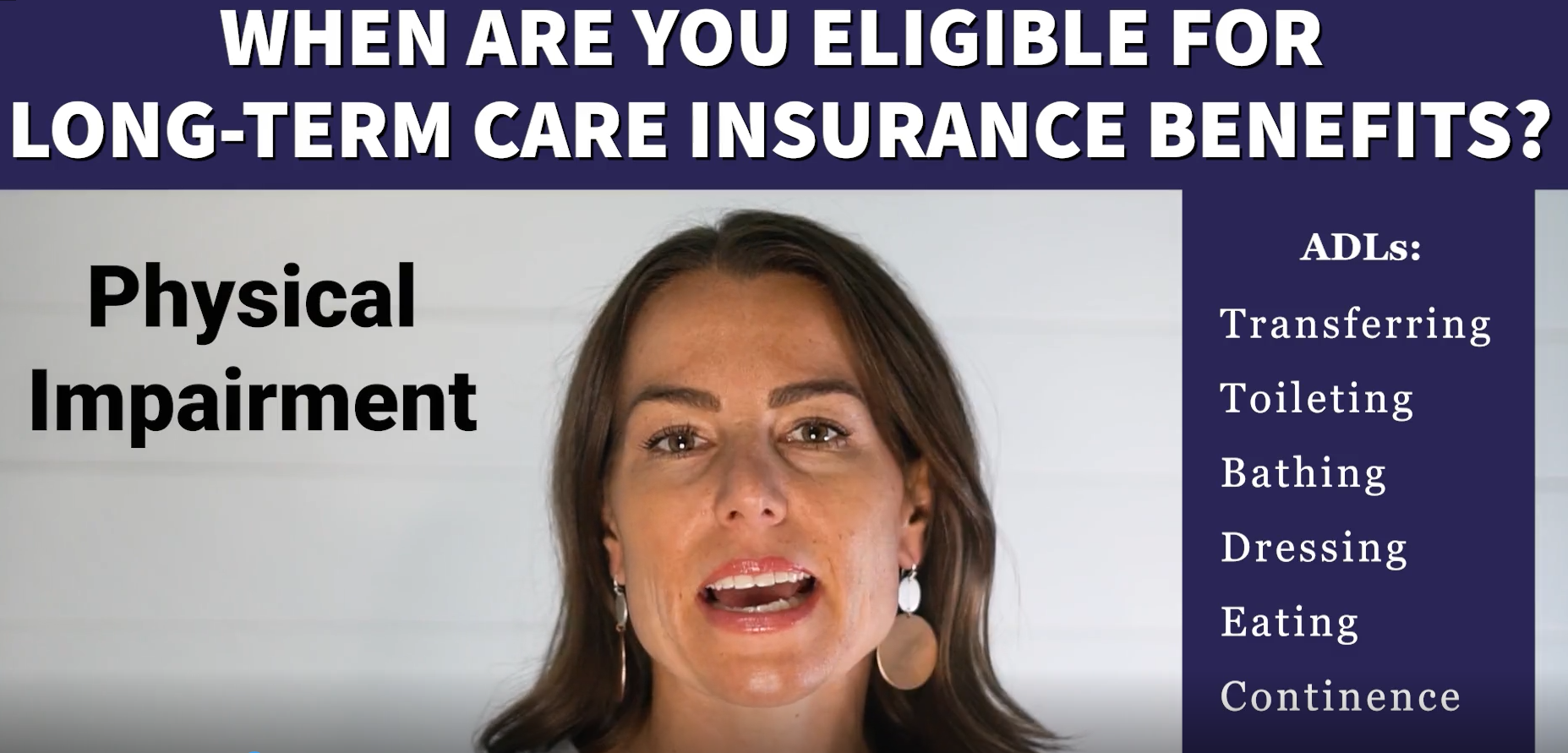

When are You Eligible for LTC Insurance Benefits?

You or a loved one has a LTC insurance policy, great! Now what? When are you eligible for benefits?

Why is Long-Term Care Insurance Valuable?

You may be able to self-fund your care costs, but why would you when you can transfer the risk to the insurance company? Here are 6...

Does Medicare Pay for Long-Term Care?

Many people believe that Medicare will cover most or all the cost of long-term care (LTC) for everyone, but that’s simply not true. Let’s

Tax Deferred to Tax Free for Long-Term Care

Learn how to leverage a current annuity with gains and use tax laws to provide tax-free long-term care benefits.

Chronic Illness vs. LTC Riders

Chronic illness and long-term care riders on life insurance policies. What are the similarities, differences, sales applications, and best practices?

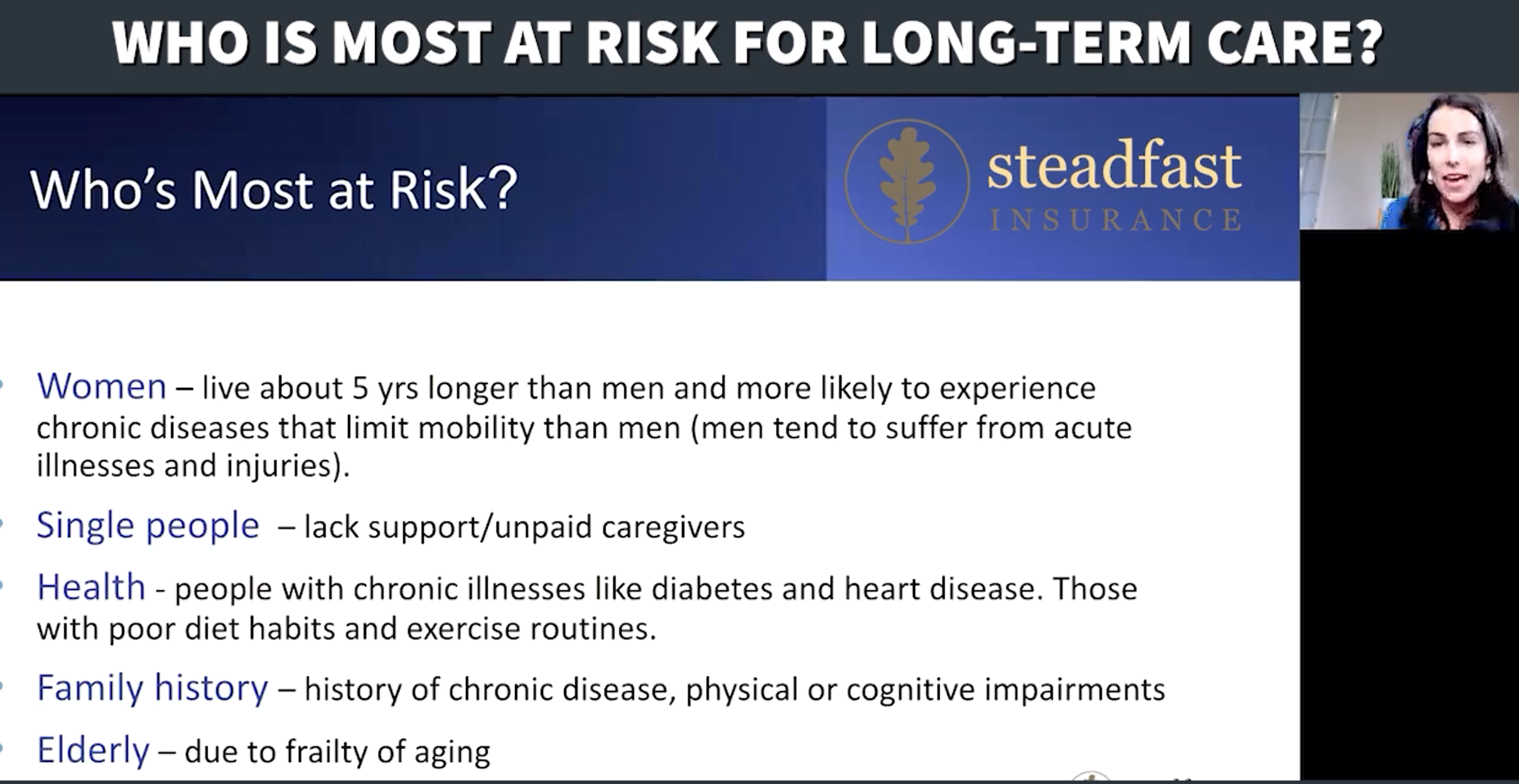

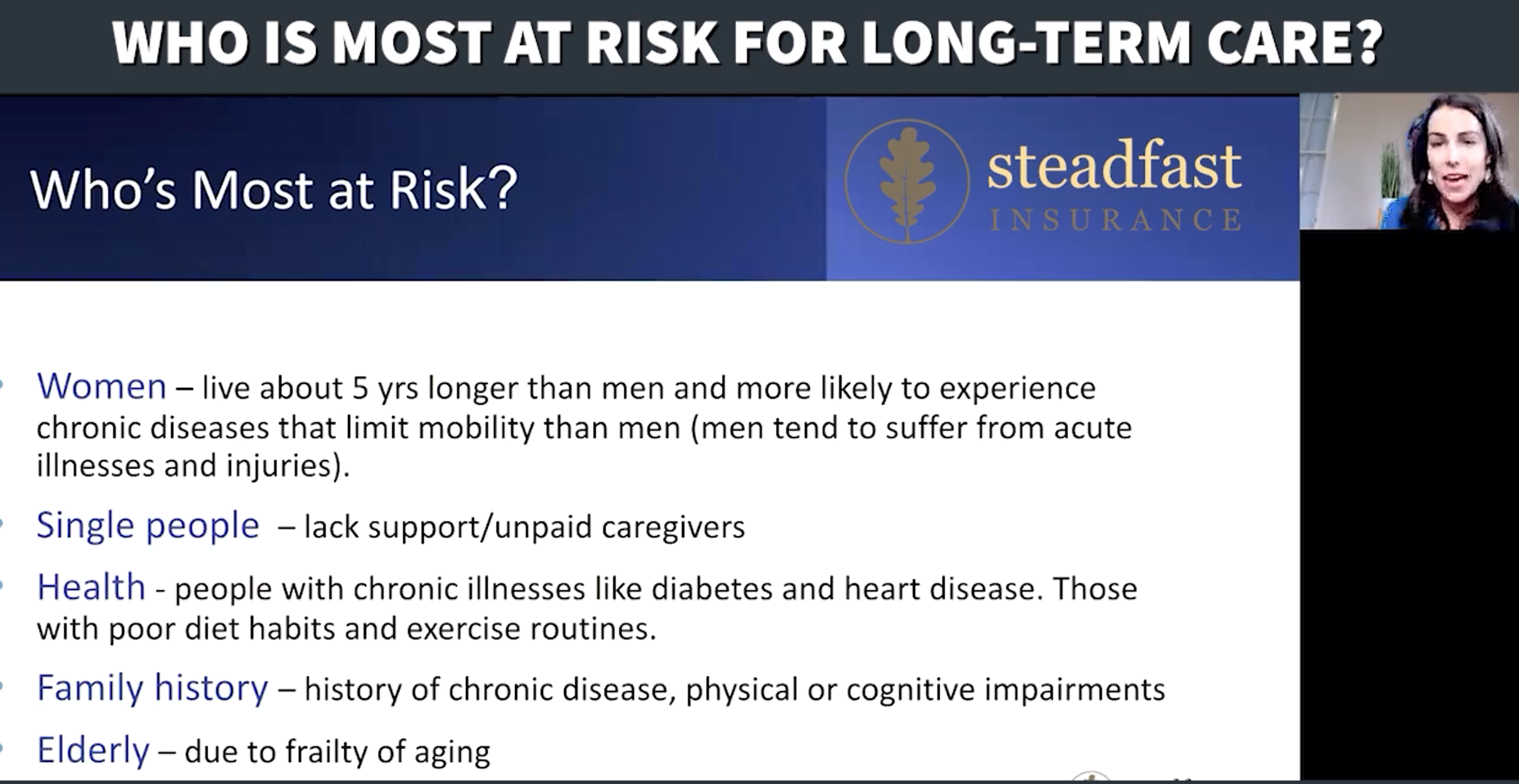

Who is Most at Risk for Long-Term Care?

Needing some assistance throughout the day due to a physical or cognitive impairment is a reality for most people. Who's most at risk?

Can LTC Insurance Pay for Home Care?

Learn where LTC insurance pays benefits.

Chronic Illness vs. LTC Riders

Chronic illness and long-term care riders on life insurance policies. What are the similarities, differences, sales applications, and best practices?

Who is Most at Risk for Long-Term Care?

Needing some assistance throughout the day due to a physical or cognitive impairment is a reality for most people. Who's most at risk?