If you’re a business owner, there are valuable tax deductions and advantages associated with long-term care insurance for you and your spouse.

Self-Employed Business Owners

Premiums for tax-qualified long-term care insurance are deductible as well as other individual medical expenses. IRC Section 213(d)(1)(D) This tax deduction is “above-the-line” on Form 1040 Schedule 1 Line 16 as part of the “Self-Employed Health Insurance Deduction.” Itemization and the 7.5% of adjusted gross income threshold are NOT required like they are for an individual.

LTC insurance premiums are deductible, but they are limited.

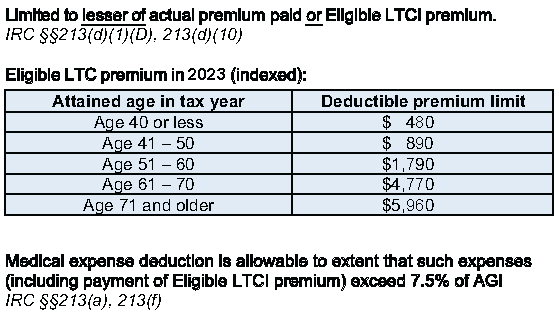

Self-employed individuals can deduct up to the age-based Eligible long-term care premium shown below.

2023 LTC Insurance Premium Deductibility Limits:

The portion of premiums above the Eligible premiums amount is NOT deductible as a medical expense.

The term self-employed includes Sole Proprietors, Partners, “greater than 2% shareholder/employee” of S-Corporations, or Limited Liability Corporation members (taxed as Partnerships).

Tip

If you’re self-employed, you cannot deduct premiums during any month when you or your spouse is eligible to participate in a plan where the employer pays all or part of the premiums for LTC insurance.

Sole Proprietors

A sole proprietor can deduct LTC insurance premiums as a self-employed health insurance expense, but the dollar amount of the deduction will be limited to the age-based premium chart. They don’t have to pay the premiums through the business. They can pay the premium personally and take the age-based Eligible premium deduction. If the premium is paid by the sole proprietorship, the owner must take the total premium paid as a draw.

If the sole proprietor buys LTC insurance coverage for both themselves and a spouse, the age-based Eligible premium limits apply to both. However, if the spouse is a bona fide employee of the business and the policy is bought and paid for as employee compensation, the full amount of the premium can be deducted as a business expense and only the owner’s premiums would be subject to the age-based limitations.

Example: Linda, age 64, is a sole proprietor and owns a marketing business.

Linda’s LTC insurance premium is $4,300 per year.

Based on the age-based eligible premiums chart, in 2021, she is eligible to deduct up to $4,520. This means she can deduct her entire $4,300 premium. If Linda were 58, she could only deduct $1,690 for 2021.

The deduction is not only available to the business owner, but it’s also available to their spouse. In our example above, Linda’s husband would qualify for his own age-based eligible premium deduction amount based on his age.

S-Corporation

A greater than 2% owner of an S corporation is treated as though they are a partner and premiums paid may be deductible to the business, but must be included in the income of the greater than 2% owner IRC Section 1372. They can claim the premium deduction as an above-the-line self-employed health insurance deduction up to the age-based Eligible premium.

S-corporation shareholder/employees could have the business pay the premium and add the total premium paid to their W-2 compensation. For tax purposes, this ensures the individual’s plan is considered an employer plan. If the premium is paid personally instead of through the business, it gets more complicated. It must be reimbursed with a written agreement for the plan to be deductible as an employer plan on the owner’s individual tax return.

Partnerships and LLCs (taxed as Partnerships)

Partners can personally deduct their LTC premiums up to the age-based premium limits. If the premium is paid by the partnership, the premium paid must be added to the partner’s K-1 as a “guaranteed payment” IRC Section 707(c)

Example: Sarah, age 58, and Dana, age 64, are 50/50 members of an LLC that last year produced $200,000 of income. They both want to purchase LTC insurance and run it through the business.

Sarah’s LTC insurance premium is $2,900.

Dana’s LTC insurance premium is $4,000.

Without LTC insurance, their income would be $100,000 each. With the LTC insurance premiums being deductible as guaranteed, business income is reduced by $2,900 + $4,000 = $6,900 to only $193,100. Since they split income 50/50, this reduces income to $96,550. Then, Sarah and Dana must each include the premiums paid on their behalf in their respective incomes, which brings Sarah’s total income up to $99,450 and Dana’s up to $100,550. Total business income is still $200,000, but Dana’s taxable share is now a little higher because her LTC insurance premium is more expensive.

Then Sarah and Dana can each deduct their LTC insurance premiums from their tax returns as a “self-employed health insurance deduction.” Sarah is limited to a deduction of just $1,690 of her $2,900 premium, while Dana is able to deduct the entire $4,000 premium because her age-based limit is $4,520.

C-Corporations

Premium payments are 100% deductible from the corporate tax return as a reasonable and necessary business expense. The deduction is not limited to the age-based eligible premiums. These are treated like traditional health and accident insurance premiums IRC Section 213(d)(1)(D).

This applies to shareholder/W-2 employees, their spouses and dependents, and all coverage paid for by the business for employees.

Employer-paid long-term care insurance is excludable from an employee’s gross income, including a shareholder/employee’s income and the benefits received are tax-free.

To be deductible, C-Corp paid premiums must be a 100% corporate expense. They are not reported from the shareholder/employee’s adjusted gross income, bonus, expense accounts, etc, even if the premium exceeds the age-based Eligible premium, and the benefits are received tax-free.

Tip

Using a limited pay option like a 10-pay provides higher tax deductions for the Corporation and allows the policy to be fully paid-up in a shorter amount of time with no ongoing premiums required. If you have “key people” in your business, this is an excellent way to encourage them to remain with your company or to attract new talent.

Non-Owner Employees

Premiums paid by any business entity for a non-owner employee and spouse are 100% deductible without any limits. They are considered a reasonable and necessary business expense like traditional health insurance premiums.

Employer-paid long-term care insurance is NOT included in the employee’s gross income and the benefits received are tax-free.

Taxability of Benefits

Another advantage of long-term care insurance premiums is the taxability of benefits received. If benefits are considered “reimbursement,” then they are tax-free. If benefits are considered “indemnity,” or “cash,” they are tax-free up to $400 per day ($12,167/mo.) in 2021. If the benefit is more than $400/day, the excess is taxable (unless an equal amount of paid care expenses above $400/day can be proven).

The Bottom Line

There are valuable tax advantages if you’re a business owner and you buy a long-term care insurance policy. Speak to an independent Long-Term Care Insurance Specialist and your CPA to find out more.

*Tax information presented here is for general information only and should not be used nor relied upon as specific tax advice. Taxpayers should consult with their CPA or tax advisor for advice regarding their own tax situation and the tax status of LTC premiums and benefits.