Long-term care expenses aren’t a drop in the bucket. They continue to rise each year, so it’s important to consider how you’re going to pay for care when you need it.

In 2021, in Columbus, OH, the median cost of home care (if you need 8 hrs/day) is almost $6,000 per month. Assisted living facilities are $4,635 per month and a private room in a nursing facility is $8,459 per month. Since these are medians, there are options below and above this. Click here to find the cost of care in your area.

If you choose to buy insurance to transfer the risk to the insurance company instead of self-funding your care costs, how much would a long-term care insurance (LTCI) policy cost?

It depends on A LOT of factors. It’s like asking how much does a car cost? Do you want a Ford Focus or a Bentley? What bells, whistles, and features do you want?

Factors that determine your long-term care insurance premiums

LTCI premiums vary by age, health, gender, marital status, benefit period, daily/monthly benefit, type of plan: traditional or hybrid, and riders that you choose to add. The older and unhealthier you are, the more expensive it will be, just like life insurance. The bigger your monthly benefit and longer your benefit period, the more expensive it will be.

Let’s look at an example:

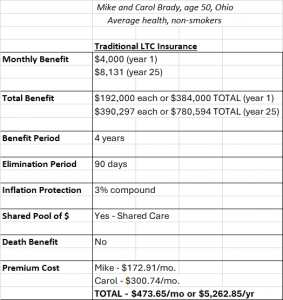

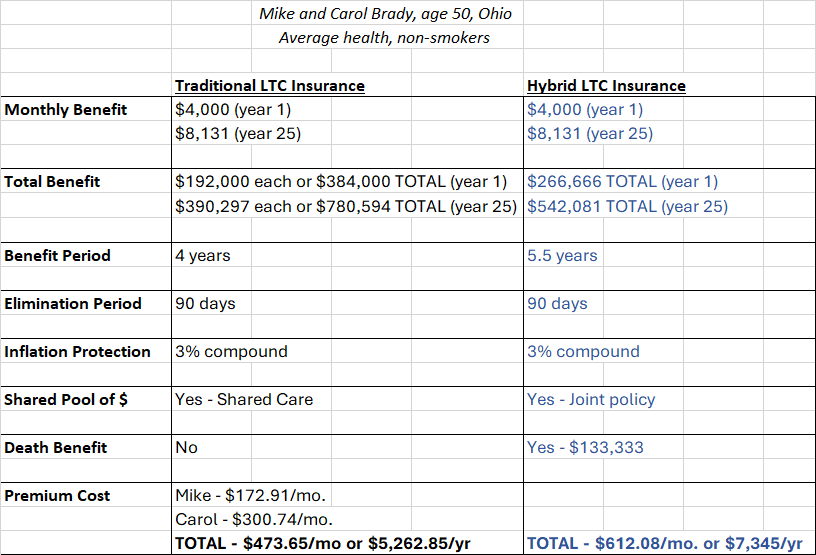

Mike and Carol Brady, age 50, live in Ohio, are in average health and are non-smokers. Since they’re applying as a couple, they’ll receive a marital discount.

Traditional LTCI Policy

Mike and Carol apply for a traditional pure LTCI policy with a leading carrier where they’ll pay annual premiums. They apply for $4,000 monthly benefit for 4 years, 90-day elimination period, 3% lifetime compound inflation protection, and a shared care rider.

It has comprehensive coverage for home and facility care.

Year one they each have $4,000 per month that they could use for care. In 25 years, that grows to $8,131 per month with a bucket of money of $390,297 EACH or $780,594 together. Since they added a shared care rider, one spouse can dip into the other spouse’s bucket of money if they use all their own benefits.

It includes a waiver of premium if once spouse goes on claim. Their combined total monthly premium for this coverage is $473.65 or $5,262.85 annually. The breakdown in premium is: Mike pays $172.91 and Carol pays $300.74.

Women will pay more than men because women go on claim more often and for longer periods of time than men.

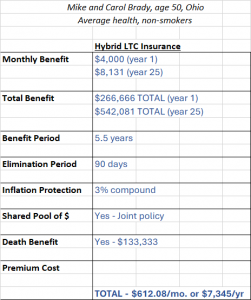

Hybrid LTCI Policy

If Mike and Carol want to apply for a joint hybrid policy that has a death benefit with a leading carrier where they’ll pay annual premiums. They apply for $4,000 monthly benefit for 66 months or almost 5.5 years, 90-day EP, and 3% lifetime compound inflation protection. It also has comprehensive coverage for home and facility care.

Year one they each have $4,000 per month that they could use for care. In 25 years, that grows to over $8,000 each per month ($8,131) with a total bucket of money of $542,081. Since this is a joint policy, they both have access to their total bucket of money. It also includes a waiver of premium if once spouse goes on claim. Their combined total monthly premium is $612.08 or $7,345 annually. It has a second to die death benefit of $133,333 if they don’t use the coverage, unlike the traditional policy.

Hybrid policies will generally be more expensive than traditional policies because there is an added benefit, such as a death benefit from the life insurance or cash value from an annuity.

Traditional vs. Hybrid

Traditional policies are harder to health qualify for than hybrid policies.

Customizable

It’s important to know that policies are customizable. There are so many options available like monthly or annual payments, limited pay options over 5, 10, or 20 years, and lump sum options or even a combo of a lump sum and annual payments.

The Bottom Line

There are many factors that determine how much your LTCI premiums are. We will work with your budget and unique situation to design a policy that is meaningful and affordable.